Get Paid Faster!

QuickBooks Payments is Intuit’s service for processing customer payments in QuickBooks Online. This add-on service was previously know as QuickBooks Merchant Services, Intuit Payment Solutions or Intuit Payment Network. It is now called QuickBooks Payments. QB Payments allows businesses to accept both credit card and bank draft (ACH) payments from customers.

QuickBooks Payments powers these payment options:

- process credit card payment directly in QBO

- process credit card payment directly in QBO mobile app

- customers pay online invoices with credit card or bank account

QB Payments is the only merchant service that can process credit cards directly inside QBO on the Sales Receipt and Receive Payments screens. The service is fully integrated in QBO and PCI-compliant, so you can securely store customer credit card information. This gives you the opportunity to automate regular charges to customers by scheduling a recurring Sales Receipt to a customer’s saved credit card.

QB Payments allows users of the QuickBooks Mobile app on iPhone and iPad to swipe a customer’s credit card within the QuickBooks app and charge the card and record the payment at the same time. The payment transaction posts directly to QBO, no downloading required. You can use the free GoPayment reader or key-enter transactions. A quick clarification: GoPayment service is a slightly different mobile payment service offered by Intuit. While similar to QB Payments – in that you swipe credit cards from mobile devices — GoPayment service doesn’t automatically post the payment in QBO…it downloads into QBO.

QB Payments is the payment service behind QBO’s online invoices. (More about online invoices here.) The business emails an invoice to a customer. The customer clicks a link inside the email. The invoice opens in a browser window. The online invoice is linked to the invoice transaction inside the QBO account. The online invoice shows the current balance due on the invoice and has an interactive messaging section for customers and businesses to communicate about the invoice. If QB Payments is activated, then the “Pay Now” button will be bright blue and customers can click & pay. The Online Invoice payment is entirely guest view – it does not require username & password log in. Credit card and bank info entered by the customer is not saved. The customer will enter their bank or credit card information each time. Both full and partial payments are allowed. Once a payment is made from the online invoice a payment confirmation screen shows to the customer, a payment confirmation email is sent to customer and the business, a receive payment transaction is posted in QBO and linked to the invoice, and the customer’s online invoice will show a status of PAID and the date payment was received.

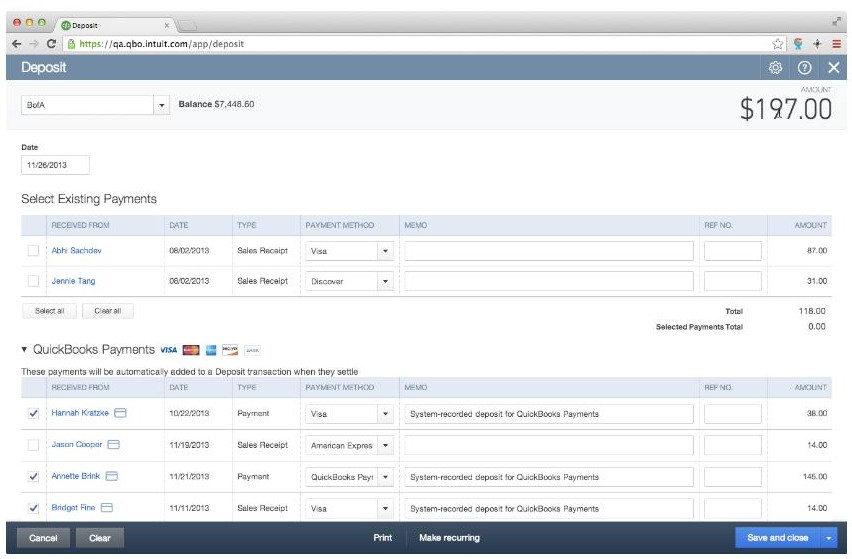

When you use QB Payments, funds move directly from the customer to the business’ bank account – funds are not impounded by any other party. There is typically a two-day window from the time the payment is submitted to the time it is received in the merchant’s bank account. If all the transactions in the batch were processed with QB Payments…whether inside QuickBooks Online (Sales Receipt / Receive Payment screen), or using QuickBooks Mobile for iPad/iPhone, or using QuickBooks Online’s online invoicing…then when the funds are deposited into the business’ bank account, the bank deposit and merchant service fees are automatically recorded in QBO by QB Payments’ auto-reconciliation feature. This means all of your QB payments move magically from Undeposited Funds to your bank register while you sleep. They use unique ID numbers to apply payments to batch deposits, eliminating guesswork and missing payments.

If your QuickBooks Online account has not yet been transitioned to the NEW platform, look for that to happen in the coming months.