2024 IRS Numbers

Every year the IRS comes out with updated numbers. Rather than having you sift through all of them, we have put together a blog that details out a few numbers you should be aware of. Here are the updated 2024 IRS numbers.

Personal Tax Changes

- The standard deduction deduction is $14,600 for Single filers and is $29,200 for Married Filing Jointly.

- The annual exclusion for gifts increases from $17,000 in 2023 to $18,000 for calendar year 2024. The lifetime gift tax/estate tax exclusion is $13.61 million per taxpayer.

- Maximum 401(k) plan contributions hae been inc to $23,000. It’s important to note that catch-up contributions (for people 50 years and over) is $7,500.

- Maximum traditional and Roth IRA contributions are $7,000, and catch-up contributions for people 50 years and over is $1,000.

- The adoption credit has been increased from $15,950 to $16,810.

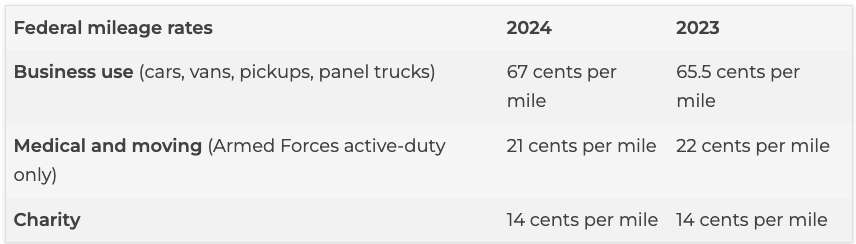

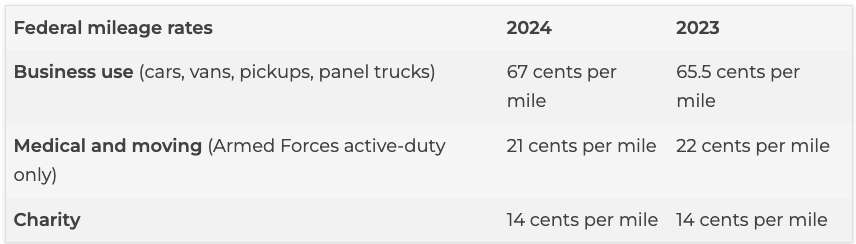

Business Mileage

Business mileage is also something you should be aware of. The deduction for 2024 has slightly increased.

As detailed on Drivernote.com, here’s a nice chart showing the updates:

Bonus depreciation

As the bonus depreciation percentage decreases, the immediate tax savings from purchasing assets decrease correspondingly.

Here is the timeline for applying bonus depreciation:

- 2023 80 percent

- 2024 60 percent

- 2025 40 percent

- 2026 20 percent

- 2027 None

- 2028 and thereafter none

Next Steps

At Redmond Accounting, we don’t do any taxes, but we can help you with all your accounting needs. Schedule a consultation today to get started.

Related Posts on Redmond Accounting CA

-

IRS Mileage Rate Changes for 2023IRS Mileage Rate Changes for 2023 The IRS has published the official 2023 rates for reimbursable and deductible mileage, and many will be happy to know the rate per mile for business-related trips has been increased. Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 65.5…

-

Intuit Accounting Professionals VIP SummitIntuit Accounting Professionals VIP Summit We're honored to be one of 40 best and brightest minds in accounting invited to Intuit's Accounting Professionals VIP Summit. "The #IntuitSummit 2013 celebrated the best and brightest minds in the accounting industry by showcasing the new QuickBooks 2014, sharing Intuit's vision for the future, and listening to the voice of our customers. Check out…

-

Cloud Accounting VS Traditional Accounting -Which is Better?Cloud Accounting VS Traditional Accounting -Which is Better? In Thomas Friedman’s book, The World is Flat, he discusses how the world, even though it is vast and spread throughout the globe, is becoming more connected every day with the use of technology. Technology is one of the major causes of “flattening” the world. As a result, the normal way of…

-

Is Accounting Automation Worth ItIs Accounting Automation Worth It As a business owner, you have a lot to do. You’re always keeping an eye out for ways you can save some time and money. But be honest with yourself and admit that there might be a better way to automate and grow your business. Using automated accounting systems may allow you to focus more…

-

4 Trends in Accounting Technology4 Trends in Accounting Technology As accounting technology experts, you know we love technology and statistics. Our article titled “How can an accounting technology expert help your business?” gave a list of statistics that showed how far accounting technology has come and how beneficial it is for businesses of all sizes. One of those fun facts was that businesses who…

-

What is Accounting Technology?What is Accounting Technology? Work smarter not harder. Whoever first said this must have run a small business. As a business owner, you are always looking to grow and build your business. With growth comes new challenges and the possibility of burning out and exhausting yourself. How can you grow in an environment that doesn’t support it? You already…

-

Unquestionable Signs When to Hire an Accounting ServiceUnquestionable Signs When to Hire an Accounting Service When you’re first starting out, it’s entirely possible to do your own accounting in the early stages of your business which is often quite simple and straightforward. But running your business means at some point, you’ll need help to continue your success. As your business grows, you may wonder when it’s time…

-

Is Outsourcing Your Accounting Tasks Beneficial?Is Outsourcing Your Accounting Tasks Beneficial? The decision to outsource your accounting tasks depends on various factors such as the size of the business, the complexity of the accounting tasks, the available resources, and the expertise required. Whether outsourcing accounting is worth it depends on the specific needs and circumstances of each business. It may be beneficial for some businesses…

-

What Makes Small Business Accounting Unique?Small businesses often face unique accounting challenges that differ from those of larger businesses. The differences between small business accounting and large business accounting are mainly due to the size, complexity, and regulatory requirements of the business. Small businesses have simpler accounting needs, while large businesses are more complex. Small businesses typically have fewer employees and lower revenue, while large…