Understanding and Combating Payments and Occupational Fraud

Fraud in financial transactions is a constantly evolving threat to companies worldwide. The Association of Financial Professionals (AFP) and the Association of Certified Fraud Examiners (ACFE) provide informational reports that offer important insights into payment fraud and occupational fraud. The latest data highlights the persistence and evolution of fraud tactics, showcasing the need for robust control measures within organizations.

Payments Fraud: Trends and Insights

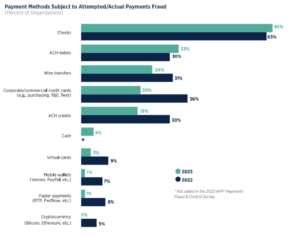

The AFP’s 2024 Payments Fraud and Control Survey, reflecting 2023 data, shows 80% of organizations faced attempted or actual payment fraud attacks in 2023. This is a substantial increase from 65% in 2022. Of those organizations that were victims of payments fraud in 2023, 30% were unsuccessful in recovering funds lost.

Check Fraud:

Checks remain the most affected payment method, with 65% of surveyed organizations encountering check fraud. Surprisingly, 75% of these organizations still plan to use checks, even as many shift towards digital payments for business-to-business (B2B) transactions. The use of checks in B2B payments has decreased from over 80% in 2004 to 33% in 2022, according to the 2022 AFP® Electronic Payments Report.

Common check fraud techniques include:

- Photocopying valid checks for multiple deposits

- Creating fraudulent checks using stolen bank account information

- Using chemical washes to alter check details, such as the payee name and amount

Digital Payment Fraud: A Declining Trend

Wire transfer fraud has decreased from 31% in 2022 to 24% in 2023, thanks to improved detection and mitigation. Organizations have increased their efforts against Business Email Compromise (BEC) scams, which often target payment systems via email, contributing to the reduction in wire fraud.

Despite these improvements, BEC scams still occur, affecting 71% of companies, with fraud attempts involving wires and ACH debits. Fraud involving other digital payment methods is also on the decline. Such as:

- Commercial card fraud decreased by 16%

- Fraud via ACH credits (push transactions, like direct deposit payroll) dropped by 11%

- Fraud via virtual cards also decreased by 6%

Organizations are actively implementing controls to prevent payment fraud, and the recent decline in payment fraud might indicate the beginning of a sustained decrease.

Rising Threats in ACH Debits

One digital payment method that has seen an increase in fraud is ACH debit (pull transactions, like autopay bills). This fraud was up to 33% in 2023 from the prior year’s 30%.

Occupational Fraud: Internal Threats

Occupational fraud, or fraud committed by employees against their employers, is another growing concern. The ACFE’s “Report to the Nations” highlights the devastating impact of such fraud, estimating that organizations lose around 5% of revenue annually to internal fraud.

With a global workforce of over 3.3 billion people, most employees are trustworthy. However, the small percentage who commit fraud cause substantial damage. The median loss per occupational fraud case is $117,125, while the average loss is $1.75 million.

Types of Occupational Fraud

There are many ways occupational fraud can occur, but the 2 most common are:

- Asset Misappropriation Schemes: This is the most common form, occurring in 86% of cases. This involves employees misusing company assets for personal use. Though frequent, these schemes are the least costly, with a median loss of $100,000

- Financial Statement Fraud: This is the most costly form of occupational fraud.These schemes involve intentional misstatements or omissions in financial reports. Examples include recording fictitious revenues or understating expenses. These cases, while less common (9-10% of cases), result in a median loss of $593,000.

A lack of internal controls is a significant contributor to occupational fraud, playing a role in nearly half of cases. The typical fraud case lasts 12 months before detection and results in a monthly loss of $8,300.

Effective Fraud Controls

Organizations can implement several inexpensive yet highly effective fraud controls to protect against both payment and occupational fraud. Here are five top strategies:

- Establish Secure Procedures: Develop secure procedures for handling financial transactions. Ensure that all employees are trained on these procedures and understand their importance. Enforcement of these procedures is key!

- Separate Financial Duties: Divide financial responsibilities among different employees to reduce the risk of fraud. No single employee should have control over all aspects of any financial transactions.

- Send Payments Securely: Use secure methods for sending and receiving payments. Avoid sending sensitive financial information through unsecured channels.

- Monitor Bank Activity: Regularly review bank statements and reconcile accounts promptly. Look for unusual or unauthorized transactions.

- Take Advantage of Technology: Implement advanced fraud detection and prevention technologies. Utilize software solutions that monitor transactions in real-time and flag suspicious activities.

These controls, when implemented correctly into an organization’s overall strategy, can significantly reduce the risk of both payment and occupational fraud. The key is to stay vigilant and proactive, continually adapting to new threats and refining fraud prevention measures.

Conclusion

Fraud in payments or within the organization itself pose significant threats to businesses. The insights from the AFP and ACFE reports mentioned at the beginning of this post show the importance of robust controls and vigilant monitoring. By understanding the constantly evolving tactics of fraudsters and placing effective prevention measures, organizations can protect their assets and ensure financial and reputational integrity. The recent decline in some types of payment fraud rates offers hope, but continuous effort is essential to sustain and build on this positive trend.

Need help understanding which protocols are best for your company? Schedule a consultation today and we can help get you and your assets protected!