Categorizing transactions is one of the most essential components of managing financial activity in QuickBooks Online (QBO). Advanced categorization gives you many options to keep your records well-organized, and ensures that your company’s financial data is recorded in a way that is both accurate and useful. Although QuickBooks offers multiple ways to categorize transactions, it’s important to choose the methods that best suit your particular business needs. This way you can ensure that your database structure will give you the most useful information.

Accounts: The Foundation of Categorization

At the core of QuickBooks’ financial database is the general ledger (GL), which records all of an organization’s financial transactions. These transactions are organized by debiting and crediting various accounts—asset, liability, equity, income, and expense accounts—so that you can create reports that accurately reflect the financial state and performance of your business.

The Chart of Accounts (COA) in QuickBooks is the table that stores this account data. It works as a master reference table that other lists and transactions pull from. For example, when you enter a check transaction, one of the fields lets you choose a vendor from the Vendor list (another table). Similarly, the account field on a check lets you designate the relevant (usually) expense or asset account from the COA.

In QuickBooks Online Advanced, there is no limit to the number of accounts or sub-accounts you can create. QBO allows for five levels of hierarchy in the account structure. A typical example might be a parent account like “Landscaping,” with sub-accounts under it for “Labor,” “Materials,” and “Plants.” Under Plants, at the third level, you could have “Trees” and “Flowers”. You could then create fourth and fifth-level sub-accounts, but there is a practical limit to how deeply you should nest accounts.

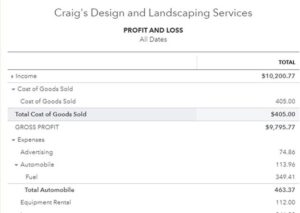

While accounts are the most basic form of categorization, creating too many levels or too many sub-accounts can make your COA, profit & loss (P&L) statement, and balance sheet cumbersome. Overcomplicating account structures can lead to errors and confusion, especially if similar names are used across multiple accounts.

For example, if you create a sub-account for “Insurance” under both “Auto” and “Office,” it can lead to confusion when entering transactions because QuickBooks allows users to search by name. By using advanced categorization methods, you can keep your COA streamlined while still getting the detailed insights your business needs.

Product and Service Items: Managing Transactions Efficiently

In addition to accounts, Product and Service items provide another useful way to categorize transactions. These items, stored in a table, represent the products and services that the business sells and that appear on your purchase and sales transactions. Every product or service is mapped to an account in the Chart of Accounts.

QuickBooks offers four types of Product and Service items:

- Inventory – Tracks quantities of items you buy or sell. (Available only in QBO Plus & Advanced.)

- Non-Inventory – Items you buy or sell but do not track quantities for.

- Service – Services you provide to your customers.

- Bundle – A group of products and services sold together, such as a gift basket.

Whenever you use a Product or Service item in a transaction, QuickBooks automatically makes the appropriate accounting entries behind the scenes based on the accounts linked to the item. For example, if you sell inventory, QuickBooks will record an increase in accounts receivable (invoice) or bank (sales receipt), an increase in revenue, a decrease in inventory, and an increase in the cost of goods sold.

With inventory management, QBO uses the First-In, First-Out (FIFO) method for valuing inventory, whereas other QuickBooks products like QuickBooks Desktop use a weighted average cost. Advanced inventory features in QuickBooks Online allow you to see the quantity available on sales forms, adjust inventory quantities, and generate physical inventory reports.

Advanced Categorization: Class, Location, and Project Tracking

While accounts and items are the basics of categorization, QuickBooks Online Plus and Advanced offer even more flexibility with Class, Location, and Project tracking. These advanced categorization tools allow you to track income, expenses, and net profit for different segments of your business.

- Class Tracking: This is useful when you want to break down your income and expenses into different segments, like departments, product lines, or business mixes. For instance, a nonprofit might use class tracking to differentiate income and expense between different funds.

- Location Tracking: This allows businesses with multiple locations (such as retail stores or franchises) to track balance sheet accounts and profit & loss accounts by location.

- Project Tracking: This feature is designed for businesses that want to track expenses and income related to a project in order to determine the profitability of projects. For example, a construction company might want to track each customer job separately to ensure profitability.

By using these methods, businesses can create reports that show exactly how different parts of the organization are performing, helping management make better-informed decisions.

Sources and Targets: Understanding Transaction Flow

In QBO’s double-entry accounting system, every transaction has both a source and one or more targets. The source represents where the transaction originates from (usually a balance sheet account), while the targets represent how the transaction is distributed across other accounts in the general ledger.

For example, when you create a customer invoice, the source is always the Accounts Receivable account. The target might be the revenue account(s) where the sale is recorded, and if it’s an inventory item, the target would also include the cost of goods sold and the inventory account.

The distinction between source and target is important because it affects how financial information is reported. For example, class tracking in QuickBooks only affects the target side of transactions and not the source. Location tracking affects both source and target accounts Understanding this structure helps you better manage your financial workflow and ensures that reports provide the desired level of detail.

You can view source and target details in any transaction by opening the Transaction Journal report, which shows debits and credits. This report provides insights into which accounts are being affected by each transaction and can reveal details that may not appear on the transaction screen itself, such as adjustments to inventory or tax liabilities.

Conclusion

QuickBooks Online offers a wide range of categorization tools to help businesses track their financial activity with precision. From basic account categorization to more advanced options like class, location, and project tracking, QBO enables businesses to tailor their financial reporting to their specific needs.

As you set up and manage your QuickBooks Online database, it’s crucial to consider which categorization methods will provide you with the most meaningful insights. Keep your Chart of Accounts streamlined by utilizing advanced categorization, and remember to understand the flow of transactions through sources and targets to ensure accurate reporting. By effectively categorizing transactions, you can ensure that your business’s financial data is organized in a way that supports informed decision-making and robust reporting.