In our previous blog post, we explored the foundational features of the QuickBooks Online Projects tool, including its dashboard, setup, and general benefits for job costing. In this follow-up, we’ll take a deeper dive into Project Reports; a robust toolset for assessing project profitability, labor costs, and unbilled time. We’ll also explain how to link labor costs to a project to get a clear view of one of the most significant expense categories for many businesses: employee time.

Tracking the Metrics That Matter

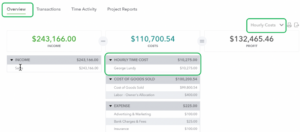

The Project Reports tab within the Projects feature in QuickBooks Online is where users can access detailed insights about a project’s financial health and progress. There are three main reports in this tab:

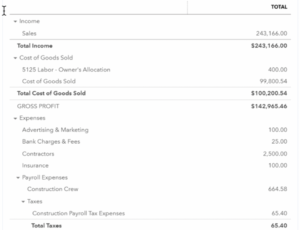

1. Project Profitability by Account

This report acts as a Profit and Loss (P&L) statement for the selected project. It provides powerful insights such as:

- A breakdown of income and expenses by account.

- The same data shown in the Project Overview screen, but in a format that can easily be emailed or exported to Excel.

- Transactions for all dates, filtered specifically for the project.

- Only posting transactions, ensuring accuracy and relevance.

Note: If your business uses hourly cost rates for labor but not QuickBooks Online Payroll, this report won’t reflect the cost of employee time, as that data is considered non-posting. This is an important consideration for businesses relying on manual or external time-tracking systems.

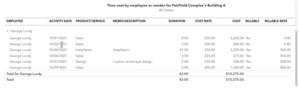

2. Time Cost by Employee or Vendor

This report details the labor costs associated with each employee or vendor who worked on the project. Which can help you identify which team members or contractors contributed to the project and assess the total cost of time logged for the project.

However: This report will only generate accurate data if time tracking is enabled, and employees or vendors select the specific project when logging their hours and hourly cost rates for employees are configured prior to entering time data.

If any of these prerequisites aren’t met, the report will display $0 for labor costs, even if time has been logged.

3. Unbilled Time and Expenses

Staying on top of unbilled items is essential for timely invoicing and cash flow management. This report includes:

- All time and expenses marked as billable that have not yet been invoiced.

- Delayed charges and credits, which are marked billable by default in QuickBooks Online.

This report ensures that no billable work is overlooked, helping you maintain accurate billing and strong client relationships.

Linking Labor Costs to a Project: A Game-Changer for Job Costing

Labor costs often represent a significant portion of overall project expenses. By linking these costs directly to projects, QuickBooks Online provides a comprehensive view of profitability. Here’s how to ensure your labor costs are accurately tracked and associated with projects.

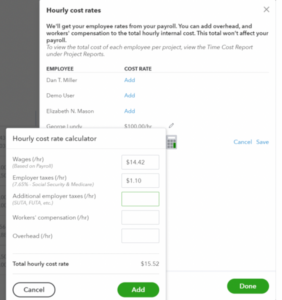

Using Hourly Cost Rates

To link labor costs using hourly cost rates:

1. Set Hourly Cost Rates for Employees

-

- Go to the Projects Center and click the Hourly cost rate button.

- In the Cost Rate column, add or edit the hourly labor cost for each employee.

- Use the built-in calculator to calculate fully burdened rates. Enter the employee’s hourly wage, and QuickBooks Online will calculate Social Security/Medicare amounts. Add estimated additional payroll taxes, workers’ compensation, and other overhead costs to get a comprehensive rate.

- Save your entries to finalize the setup.

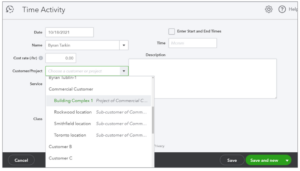

2. Assign Time to Projects

- When employees log their hours in a timesheet, they must select the relevant project from the Customer dropdown field.

- Complete the timesheet with all required details and save it.

3. Calculate Labor Costs:

-

- QuickBooks Online multiplies the hourly cost rate by the number of hours logged in the timesheet.

- These labor costs appear on the Project Overview tab under the Hourly Costs view and in time-related reports.

Using QuickBooks Online Payroll

If your business uses QuickBooks Online Payroll, labor costs are even more seamlessly integrated into projects:

- When time is entered into timesheets, it transfers directly to employee paychecks.

- Costs for earnings and taxes are automatically allocated to projects based on timesheet entries.

- Once paychecks are created, actual labor costs (including payroll taxes) are visible in the Project Overview tab by selecting the Payroll Expenses view from the dropdown menu above the income and costs section.

Pro Tip: Regardless of whether you use hourly cost rates or QuickBooks Payroll, accurate time tracking is critical for linking labor costs to projects. Ensure your team consistently logs time and assigns it to the appropriate project.

Best Practices for Accurate Reporting and Costing

To get the most out of QuickBooks Online’s Projects feature, consider the following tips:

- Enable Time Tracking: Go to Account and Settings > Time Tracking to ensure this feature is active.

- Train Your Team: Educate employees and vendors on the importance of selecting the correct project when logging time.

- Review Reports Regularly: Schedule periodic reviews of project reports to catch discrepancies early and ensure accurate billing.

- Customize Your Reports: Export reports to Excel for further customization, such as adding pivot tables or additional formatting for presentations.

Unleashing the Full Potential of QuickBooks Projects

QuickBooks Online’s Projects feature makes it easy to track labor costs and see exactly how they impact your bottom line. With detailed reports like Project Profitability by Account, Time Cost by Employee/Vendor, and Unbilled Time and Expenses, you’ll have the insights you need to make smarter decisions, manage costs more effectively, and ensure every billable hour counts.

Whether you’re a contractor, consultant, or running a project-based business, these tools help you stay on top of your finances and maximize profits. Set up your labor costs and reporting today, and turn project tracking into a powerful advantage.