Automating Invoicing and Payments for Subscription Services

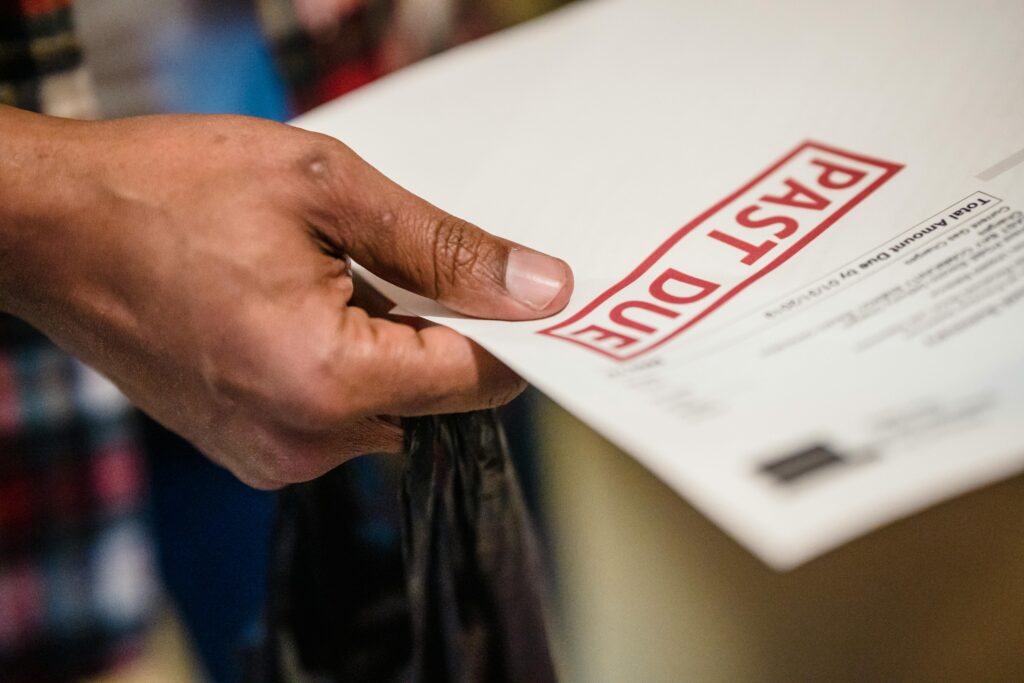

Automating Invoicing and Payments for Subscription Services Subscription based businesses rely on consistency. Predictable revenue, recurring clients, and ongoing service delivery are what make the model attractive. Yet many subscription businesses still handle invoicing and payments manually, creating unnecessary work, delays, and cash flow gaps. Automating invoicing and payments is one of the most […]

Automating Invoicing and Payments for Subscription Services Read More »