The Importance of Recurring Transactions

For many businesses, financial transactions are repeated month after month. In fact, it’s estimated that about 80% of transactions fall into this category. Instead of manually entering the same data every time, QuickBooks Online (QBO) provides two primary ways to automate this process:

- Bank Rules – These automate transaction categorization based on patterns in the bank feed.

- Recurring Transactions – These create templates for transactions that are repeatedly recorded.

While bank rules and recurring transactions share similarities, they are used in different scenarios. We are going to focus on recurring transactions, covering when and how to use them efficiently.

When to Use Recurring Transactions

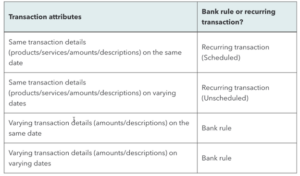

The choice between bank rules and recurring transactions depends on the type of transaction and whether it appears in the bank feed. Here’s a quick breakdown:

- If the transaction affects a bank or credit card account and the account is connected to QBO, then bank rules are preferable.

- If the transaction affects a bank or credit card account but the account is not connected to QBO, then recurring transactions should be used.

- If the transaction does not affect a bank or credit card account, bank rules cannot be used, so recurring transactions are necessary.

For example, recurring invoices are ideal when invoicing customers for the same amount each month. Unlike bank rules, recurring invoices can be automatically emailed, scheduled, or used as reminders.

Why Use Recurring Transactions Over Bank Rules?

Even when transactions go through the bank feed, recurring transactions may still be the best choice. If a transaction involves product or service items, use recurring transactions because bank rules cannot apply item-based details.

For instance:

- If your business sells products and needs itemized sales reports, a recurring sales receipt is the best option.

- If you track purchase orders with specific items, a recurring purchase order is necessary.

Bank rules only assign categories but do not allow for detailed product/service tracking.

How to Set Up Recurring Transactions

Recurring transactions create templates to streamline data entry. You can create a new template from:

- The Recurring Transactions Screen (ideal for setting up from scratch).

- An Existing Transaction (by selecting “Make Recurring” at the bottom of the transaction form).

There are several transaction Types Eligible for Recurring Templates:

- Bills

- Checks

- Credit Card Credits

- Credit Memos

- Deposits

- Estimates

- Expenses

- Invoices

- Journal Entries

- Non-Posting Charges (Delayed Charges)

- Non-Posting Credits (Delayed Credits)

- Purchase Orders

- Refunds

- Sales Receipts

- Transfers

- Vendor Credits

Note: You cannot create recurring transactions for Receive Payment or Pay Bills because recurring templates only apply to the first step in a workflow. For example, you can set up a recurring invoice but not an automatic payment received.

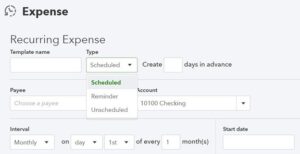

Types of Recurring Transaction Templates

There are three types of recurring transaction templates:

1. Unscheduled Templates

- These templates store transaction details without a set date for processing.

- Best used for transactions that need modifications before being finalized.

Examples:

- Pre-Populated Estimate Templates: Used when estimates have a consistent structure but require slight modifications for each customer.

- Complex Journal Entries: Useful for payroll or other transactions requiring multiple accounts with varying amounts.

- Generic Invoices: Create an invoice for common services and adjust details before sending it to different customers.

2. Scheduled Templates

- Automatically create and process transactions at a specified frequency.

- Ideal for payments and invoices with fixed amounts.

Examples:

- Recurring Invoices: Automate monthly billing for a subscription or retainer service.

- Recurring Auto-Pay from Customers: Set up sales receipts with auto-pay to collect funds without manual intervention.

- Recurring Bills: Schedule recurring expenses like rent or lease payments.

- Recurring Journal Entries: Automate depreciation or amortization adjustments.

3. Reminder Templates

- A hybrid option that creates a transaction but requires approval before posting.

- Best for transactions where amounts or details change slightly each period.

Example:

- If a customer’s invoice amount varies each month, a reminder template ensures accuracy while automating the process.

Important Note: Avoiding Duplicate Entries

While recurring transactions and bank rules are both powerful automation tools, using both for the same transaction can create duplicate entries in the general ledger. Be mindful of how transactions enter your books to ensure clean, accurate records.

Conclusion:

By effectively utilizing recurring transactions, businesses can save time, reduce errors, and improve efficiency in financial management.