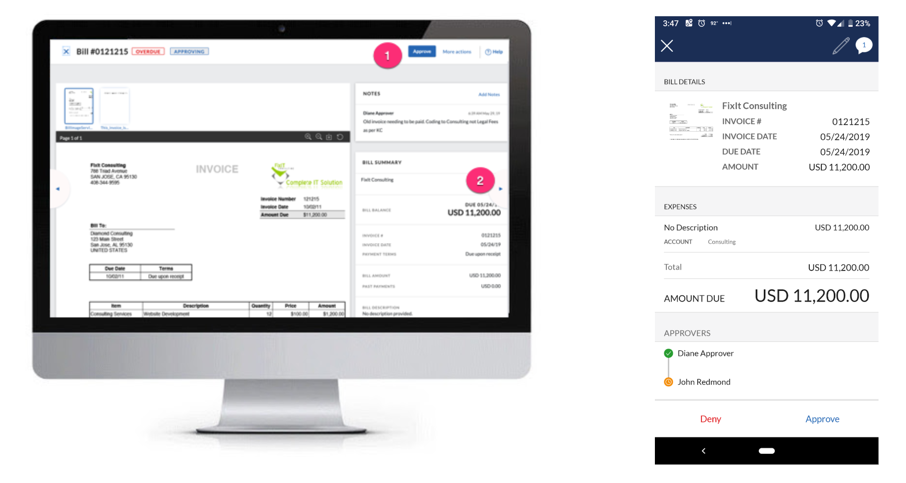

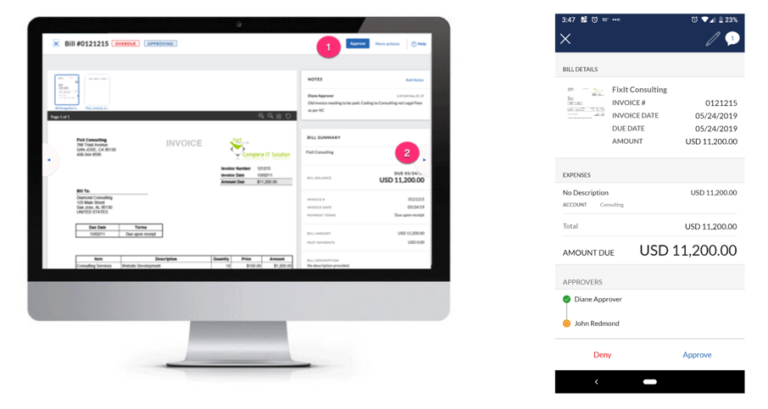

Bill.com’s New Interface (1 of 2)

You’ve heard us preach about the benefits of paying vendors by using online bill pay solutions. Bill.com is our favorite app for this.

Over 3 million users process more than $60 billion in payments annually using Bill.com. This app allowed us to stop printing checks, obtaining signatures, stuffing envelopes, affixing stamps, and taking them to the post office to mail.

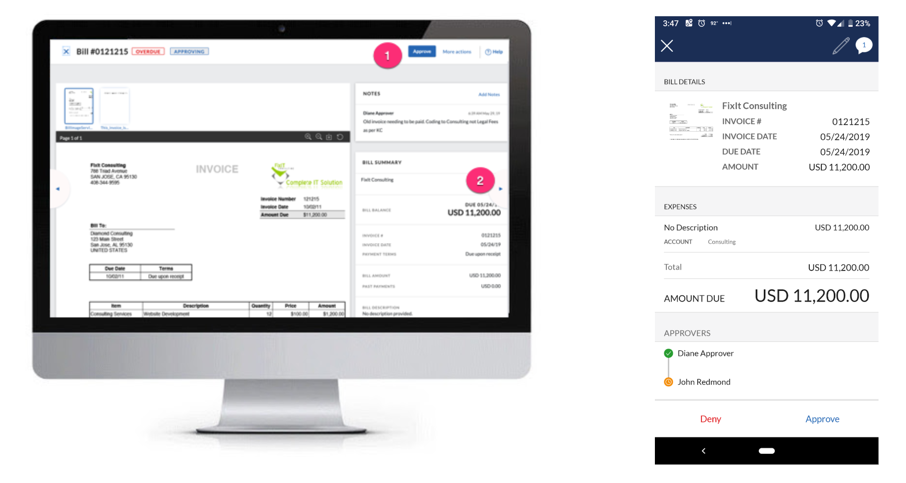

Bill.com’s approval process allows for multiple people within an organization to confirm bills are accurate, legitimate, and authorized for payment. This creates a separation of duties between users, a critical control for fraud prevention.

Bill.com is launching a newly designed interface. They performed over 60 user research studies and worked directly with over 350 businesses to ensure that they built features that make life easier for you.

You will notice the new design whether you log in via a web browser on your computer or the mobile app for iPhone or Android. You can manually switch your account to the new interface or wait for Bill.com to convert it automatically for you.

Use this checklist with step-by-step instructions for reviewing bills for approval. Tune in next week for our in-depth procedure guide.

Reduce your accounting workload so you have more time for everything else. Schedule a 15-minute call with us.

Read part 2 about approving bills…

Related Posts on Redmond Accounting CA

-

Bill.com, a Cornerstone of Our BusinessBill.com, a Cornerstone of Our Business We at Redmond have been using Bill.com for a decade. It is an intelligent way to create and pay bills. And it is truly a cornerstone of our business. It exemplifies the modern methods of accounting that we evangelize - from security to automation to electronic payments to online access. In December, we were…

-

Approving Bills With Bill.com Approval ProcessApproving Bills With Bill.com Approval Process Last week we spotlighted one of our favorite apps for online bill pay to vendors - Bill.com. We showed you their new interface along with this checklist with step-by-step instructions for users approving bills. Let’s take a closer look. Our experts can automate your bill pay process. Schedule a free consultation! Schedule now The…

-

Time Travel is HereTime Travel is Here Over 5.6 million customers globally use QuickBooks Online (QBO). Keeping that data secure is a top priority for Intuit, the makers of QBO. QuickBooks Online automatically backs up your data with the same level of security used by banks and financial institutions. Whenever there are changes to your QBO data, it is saved in multiple locations…

-

Great Practice SpotlightGreat Practice Spotlight We were spotlighted as a "Great Practice" by CPA Practice Advisor: An all-online attitude, extreme organization, and an outsourced accounting service model create the perfect mix for success. Standardization has a new poster child—and her name is Laura Redmond, owner of Redmond Accounting. For those that pride themselves on being ultra organized…you may have met your match.…

-

Cash Flow 101Cash Flow 101 Cash in the bank is comforting. You use it to pay bills, buy inventory and expand your business. Your bank account balance tells you how much cash you have at that moment. But how much will you have in a week, a month, a quarter? That’s where cash flow comes in. Cash flow is a measurement of…

-

Connecting Apps with ZapierConnecting Apps with Zapier There’s so much information circulating at our fingertips via social media, email and push notifications. I can’t possibly read all the articles I’m interested in and still get all my work done. When I see an article or website that I want to read when I don’t have time, I click the Zap extension on my browser.…

-

Workflow: Company Credit CardsWorkflow: Company Credit Cards Businesses generally follow best practices for purchasing goods and services by using controls such as purchase orders, check requests, and approval for vendor bill payments. But what happens when they pay by credit card? Our experts can automate your company credit card process. Schedule a free consultation! Schedule now Some businesses have one or two company…

-

7 essential Chrome browser features you should be using7 essential Chrome browser features you should be using by Kaitlyn Means Chrome is the browser of choice for most internet users. It has so many features that make my work as a cloud accountant at RAI easier. Here are my favorite Chrome tips, tricks, and hacks. Back button history Have you ever been on a website or in a…

-

A case of check fraudA case of check fraud We will periodically post summaries of our experiences with other small businesses in an effort to share problems and solutions and learn from each other. The Problem: A growing company with 50+ employees suddenly discovered that they were the victims of check fraud. The on-staff bookkeeper had forged the principal's signature on several checks made payable to…