Businesses generally follow best practices for purchasing goods and services by using controls such as purchase orders, check requests, and approval for vendor bill payments. But what happens when they pay by credit card?

Our experts can automate your company credit card process. Schedule a free consultation!

Some businesses have one or two company credit cards that are used by multiple staff. Other businesses issue named credit cards to individual staff. The end result is often the same: the accounting department receives a monthly credit card statement and makes the payment, typically with no authorization or supporting documentation of individual purchases. You’re not going to skip a credit card payment and risk fees or a maxed-out credit limit that the business depends on.

But does the business follow up and require the supporting documentation showing the detail of items purchased for every line on the credit card statement? Does the business get approval from each purchaser and then manager on every line on the credit card statement? The business would require that to pay a bill or issue a check or petty cash.

What if an unauthorized purchase is made? What if the amount charged wasn’t the agreed-upon amount? Where is the supporting documentation? How do you organize and archive all of this detail in case of future audit? Is the coding on the books accurate for all of the many, many line items on a credit card statement? (Credit Card expense account is not the correct category!)

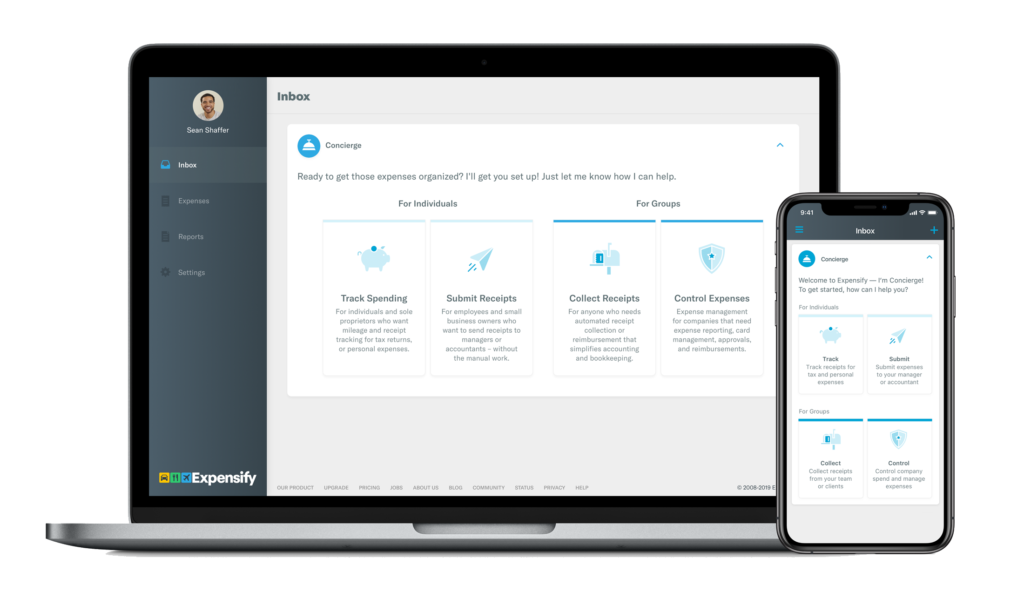

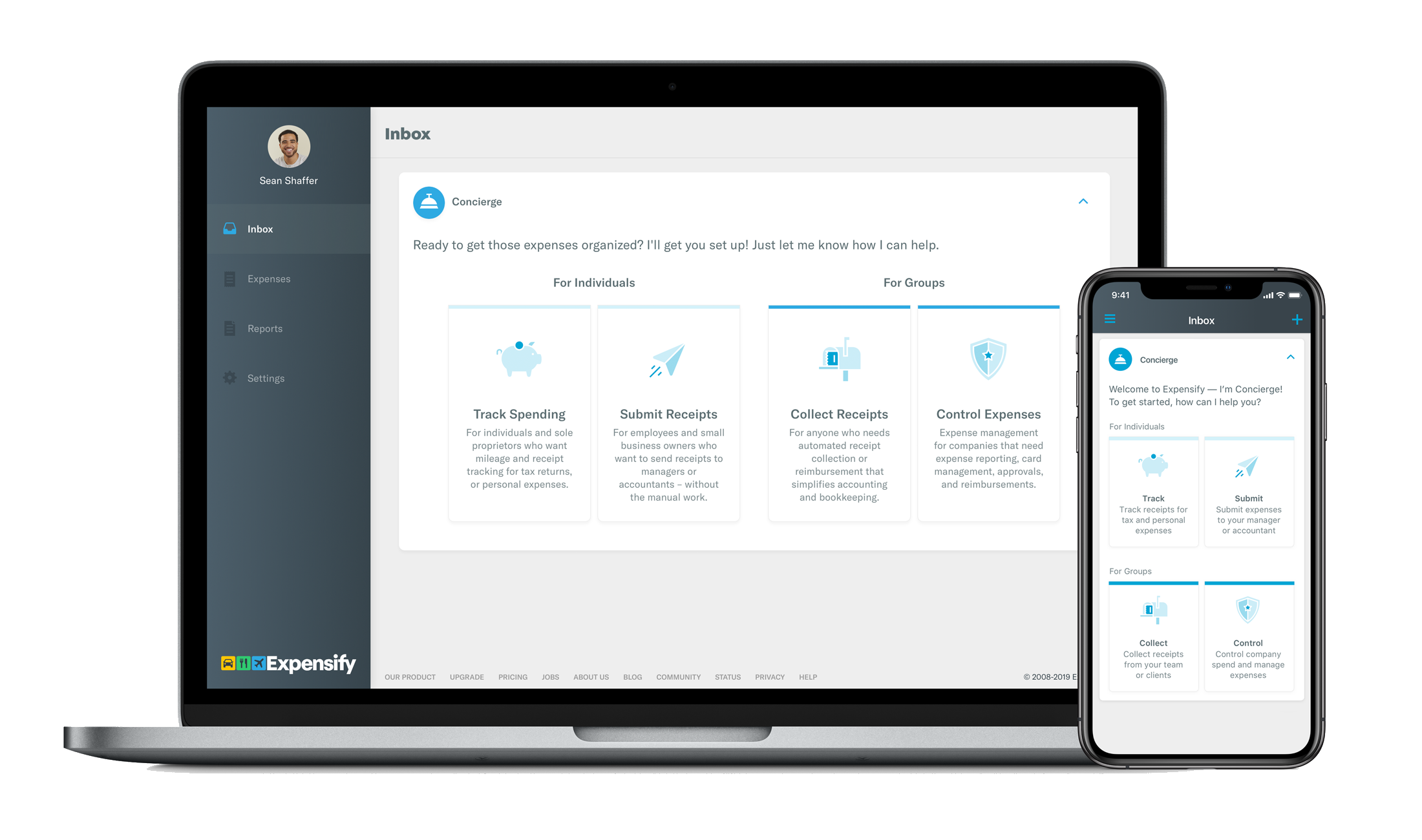

Enter Expensify.

Expensify makes it easy to get reimbursed. And that same workflow makes it possible for businesses to manage their company credit card purchases. Here’s how it works:

- Link Expensify to the credit card’s online banking account and assign each card to the appropriate cardholder (domain control)

- Expensify automatically grabs the date, merchant and amount so the cardholder doesn’t need to enter that data manually

- The cardholder simply signs into Expensify to categorize and attach a receipt on each purchase. You can configure Expensify to automate much of this with Rules, the mobile app, auto-forwarded email receipts, and e-Receipts.

- Purchases are grouped into reports and submitted for approval. The cardholder can schedule reports to be automatically submitted.

- Every purchase on approved reports is recorded on the books (QuickBooks, etc) at the push of a button or automatically: debit to expense or asset account (generally), credit to Credit Card Liability account.

- The statement arrives from the financial institution monthly and is paid: debit to Credit Card Liability account, credit Cash (Checking, AP, etc).

- And finally, the Credit Card Liability account is reconciled to the statement each month, just as you would a checking account or other source of payment, to make sure all activity is recorded, no duplicates. This usually takes seconds, since the source of the activity comes from the bank feed.

Not only does Expensify give us a collaborative tool between the cardholder and company, but take note of the automation that Expensify has built. The accounting can do itself.

News Flash: Expensify has just launched its very own Expensify Card:

- No fees. No commitments. No interest.

- The total amount of daily purchases is automatically withdrawn from the checking account each day. Expensify won’t let you spend more than you have.

- This opens up the opportunity for businesses to use a card for purchases in larger amounts than they normally can with too-low credit limits from traditional financial institutions.

- Cardholders who do not submit their expenses after a period of time will find that their card no longer works until they submit.