Bank Feed Skills for Closing the Books

In previous blog posts, we’ve covered the essential knowledge required to close the books. Now, it’s time to put that knowledge into action by mastering the skills necessary to efficiently close the books. We are going to focus on advanced topics related to the QuickBooks Online (QBO) bank feed, helping you streamline processes, prevent fraud, and establish an effective workflow.

Automation: The Power of the QBO Bank Feed

QuickBooks Online simplifies financial management by automatically importing transactions from your connected financial institutions. This bank feed functionality significantly reduces manual data entry and enhances accuracy. Here’s what QBO imports from your bank:

- Date: The posting date when the transaction was recorded at the bank.

- Detail: A description of the transaction, such as a wire transfer, branch deposit, merchant name, or check number.

- Amount: The monetary value of the transaction, whether deposited or withdrawn.

- Bonus: Some banks now allow QBO to pull images of cleared checks, making it even easier to verify transactions.

Since this data is automatically imported, your main task is to categorize transactions correctly to ensure they are recorded in the General Ledger. Establishing an optimal frequency for processing the bank feed is crucial because:

- It helps complete the monthly close process sooner, allowing leadership to review financials promptly.

- Timely financial reports empower companies to make informed decisions based on accurate data.

Fraud Prevention: Strengthening Financial Security

Fraud prevention is a crucial aspect of financial management, and the QBO bank feed plays a vital role in detecting and preventing fraudulent transactions. Regularly monitoring bank activity is one of the top ways to protect your company from financial threats.

How the QBO Bank Feed Helps Prevent Fraud:

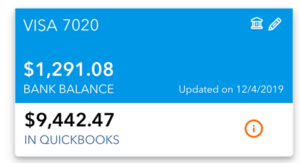

- Real-time visibility: The banking screen in QBO provides instant access to your balance and transaction details.

- Frequent validation: Matching bank feed transactions to those recorded in QBO ensures discrepancies are caught sooner, preventing potential fraud before the monthly reconciliation.

- Immediate action: Unrecognized transactions can be investigated promptly.

- Credit card monitoring: Employees with company credit cards should regularly review their statements for unauthorized activity.

- Fraud response: If fraudulent transactions are detected in time, most credit card companies will deactivate compromised cards, issue replacements, and provide refunds for unauthorized charges.

Additional Fraud Prevention Strategies:

- Independent review: Have an owner, officer, or a non-bookkeeping team member review bank statements monthly.

- Digital statements: Encourage logging in to electronic bank statements to prevent sensitive information from being stolen through physical mail.

- Banking alerts: Set up notifications for withdrawals exceeding a specific amount or other unusual activities.

- Immediate fraud alerts: Take fraud warnings from your financial institution seriously and act quickly.

- ACH debit block: Consider enabling this feature to block unauthorized ACH withdrawals.

Establishing a Consistent Workflow

A well-structured workflow ensures consistency, efficiency, and accuracy when working with the QBO bank feed. To maintain a smooth process, follow the checklist suggestions provided in this blog post.

There are many benefits of using checklists, such as:

- They help you remember what, how, and when to perform each task.

- Ensure consistency and efficiency.

- Provide a log of completed tasks for reference.

Scheduling Bank Feed Processing:

- For companies with high transaction volumes, working the bank feed daily or weekly is recommended.

- If transaction volume is low, processing bank feeds once a month may be sufficient.

- Completing this process throughout the month allows for a quicker month-end close.

- Troubleshoot bank connections before starting to ensure all transactions are imported correctly.

Troubleshooting Bank Connections in QBO:

- Check the update status: If the bank feed hasn’t updated in over 24 hours, click the “Update” button.

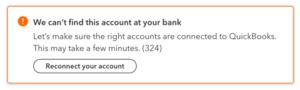

- Look for error messages: Identify any connection issues by checking for orange exclamation marks or error notifications.

- Follow on-screen instructions: Click error icons to view messages and follow the suggested steps.

- Use “Manage Connections”: If issues persist, navigate to “Link Account > Manage Connections” to reset your bank link.

- Disconnect and reconnect: If necessary, disconnect and reconnect the bank account, ensuring you select the correct start date to avoid duplicates.

- Contact QBO support: If all else fails, provide the error message ID to QBO support for assistance.

Additional Key Concepts

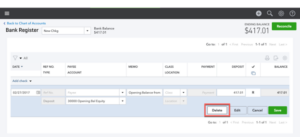

1. Initial Connection – Handling Opening Balances

- When connecting a new account, QBO automatically records an opening balance entry, offsetting it against the Opening Balance Equity account.

- This should be deleted to ensure transactions are accurately recorded from the actual bank activity rather than a system-generated entry.

2. Avoiding Duplicate Transactions

- QBO may import transactions that were already manually entered and reconciled.

- Review transactions carefully before adding them to the ledger to prevent duplication.

- Use batch tools to quickly exclude unnecessary transactions if many duplicates appear.

3. Manually Uploading Bank Transactions

- If direct bank connections aren’t available, you can download bank transactions in .QBO, .QFX, .CSV, or .OFX format and upload them to QBO.

- Web-connect files (.QBO and .QFX) are preferred as they require less manual mapping of fields.

- Apps like PDF2QBO can convert bank statements into uploadable formats.

4. Managing Credit Card Sub-Accounts

Companies that issue multiple credit cards to employees have different options for managing bank feeds:

- Connect the parent account: Work the bank feed at the master account level.

- Connect individual cardholder accounts: Assign each cardholder’s transactions to their sub-account for easier tracking and reconciliation.

- Use an expense management app: Apps like Expensify allow cardholders to categorize their transactions and submit them for approval before syncing with QBO.

Conclusion

Mastering the QBO bank feed is a crucial step in efficiently closing the books. By leveraging automation, maintaining vigilance against fraud, and establishing a structured workflow, businesses can streamline financial processes and improve accuracy. Whether you’re processing transactions daily, weekly, or monthly, implementing these best practices will ensure a smoother month-end close and more reliable financial reporting.

Stay proactive, stay organized, and close the books with confidence!